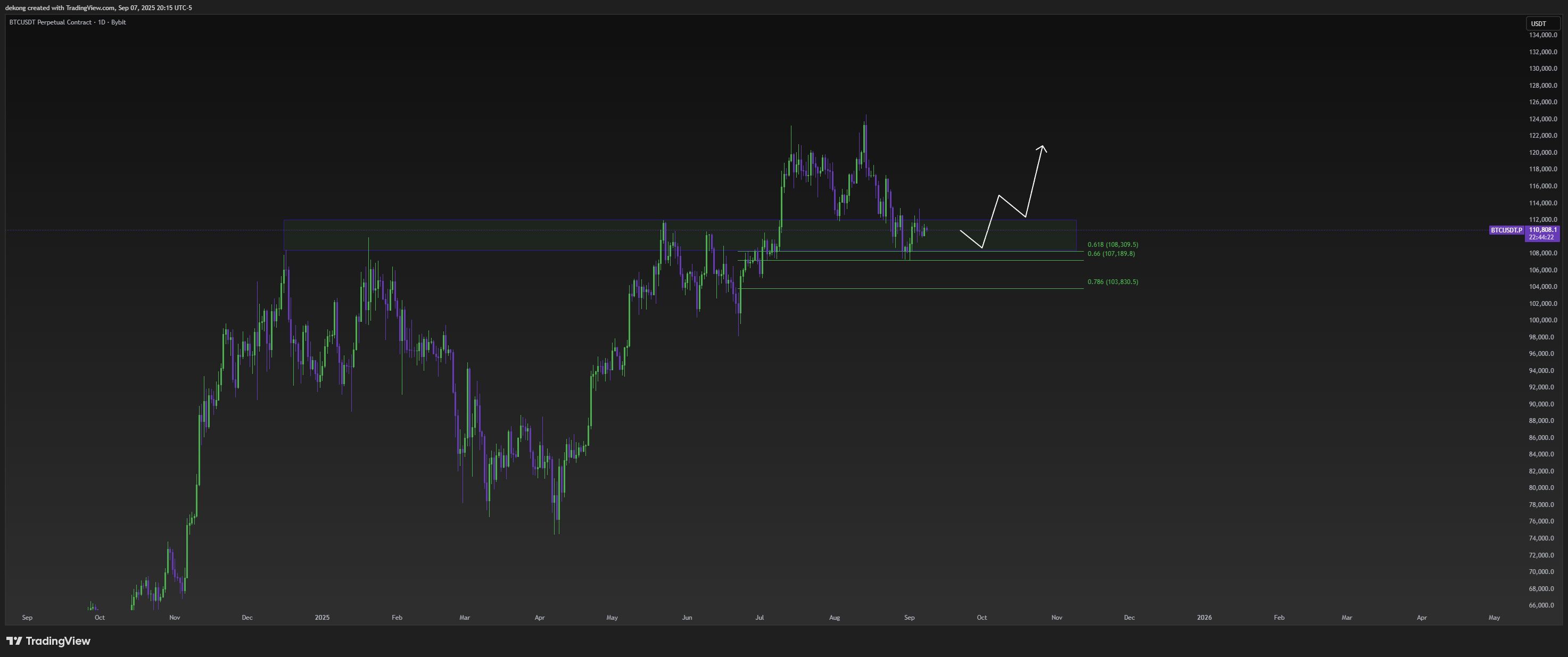

$BTC/USDT

👀 On rebondit sur le golden pocket du dernier swing low, mais le marché choppe autour de cette zone S/R avec très peu de volume.

📊 Rejet autour de $112,500 ; septembre reste historiquement bearish, mais si cette boîte tient encore quelques semaines, le bull market pourrait continuer jusqu’à la fin d’année.

💡 Opportunité réelle : surveiller la consolidation dans cette zone pour anticiper un breakout haussier ou se préparer à un pullback correctif.

👉 Es-tu prêt à prendre position avant que le marché ne tranche ?

#Bitcoin #BTC #trading #cryptocurrency #technical analysis

Carmelita

2025-09-08 14:03

💥 $BTC à un niveau décisif : breaker ou rebondir ?

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

BTC has had a ~15% drop from the peak of 124kxx, there is still no recovery wave, the current price is trading around 110k

D1 closed a green candle but did not say anything

The NFP data released on Friday last week was bad, pulling the price back up to 113k, at the same time, the previous KC pulled out the beard and sold off strongly

Looking from above, BTC is still sideways, running down in the wave 119-107

-On H1 (drawing), you can see that this section needs to build another leg around the support d1 (107k) to be able to pull up again

-Trhop2: the price drops the beard to 104kxxx, then you wait to catch the previous liquidity gap price zone

Strategy to wait for Long candles in the 2 price zones of 107k and 104kxxx

#ETH, this section supports around 4200, builds for quite a long time but still does not have enough liquidity to go up + BTC is not favorable, there will likely be a 4k swinglow sweep then consider going up

Wishing you guys a lucky start of the week, successful trading!

#Jucoin #JucoinVietnam #BTC #Bitcoin

Lee Jucoin

2025-09-08 07:10

BTC Update 8/9

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

$BTC/USDT vient de clôturer au-dessus de $111K. 👉 Les analystes fixent le pire scénario à ~$100K (-10%).

⚡ Petit rappel historique : lors des cycles passés, Bitcoin encaissait des corrections de 30–40% avant de repartir en orbite.

➡️ Si -10% est désormais le maximum de douleur… alors les taureaux mènent la danse.

#Bitcoin #BTC #crypto #CryptoMarkets

Carmelita

2025-09-07 22:38

📊 Bitcoin bulls flexing their dominance

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

$BTC/USDT

🇸🇻 NEW: Président Nayib Bukele annonce qu’El Salvador achètera 1 Bitcoin par jour 💥

👉 Jusqu’à ce que le BTC devienne “inabordable avec les monnaies fiat.”

Une stratégie long terme qui pourrait redéfinir le rôle des États dans l’adoption #Bitcoin .

#BTC #ElSalvador #crypto #cryptocurrency #

Carmelita

2025-09-07 12:44

🇸🇻 NEW: Président Nayib Bukele annonce qu’El Salvador achètera 1 Bitcoin par jour 💥

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

👉 Avec $46.49M de levier en liquidation positionné à ce niveau.

Des clusters s’accumulent au-dessus & en dessous… ⚡ La volatilité s’annonce explosive. 👀

#Bitcoin #CryptoMarkets #BTC #cryptocurrency #blockchain

Carmelita

2025-09-07 11:42

🚨 JUST IN: $BTC vient de taper $112,349

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

🚀 Latest Bitcoin Price Predictions: Bull Run to Continue in 2025!

With Bitcoin currently trading around $113,762, experts are overwhelmingly bullish on BTC's future prospects. Here's what the latest analysis reveals about Bitcoin's price trajectory:

💰 2025 Price Targets:

-

Conservative estimates: $120,000 - $135,000

Bullish predictions: $150,000 - $175,000

Ultra-bullish: Up to $230,000 (Digital Coin Price)

Cathie Wood (Ark Invest): Path to $1 million within 5 years

📈 Key Price Predictions by Year:

-

2025: Average $125,027 (range: $84,643 - $181,064)

2026: Average $111,187 (range: $95,241 - $150,000)

2030: Average $266,129 (range: $198,574 - $500,000)

Long-term: Some analysts predict $900K+ by 2030

🎯 What's Driving the Bullish Outlook:

-

Post-halving momentum (April 2024 halving reducing supply)

Massive institutional adoption via Bitcoin ETFs

Growing acceptance as digital gold and inflation hedge

Potential Federal Reserve rate cuts boosting risk assets

Strong political support and clearer regulations

📊 Technical Analysis Insights:

-

200-day moving average trending upward since January 2025

Current RSI in neutral zone (30-70), indicating room for growth

Fear & Greed Index at 50 (neutral), historically preceding rebounds

14/30 green days in the last month showing resilience

⚡ Key Catalysts to Watch:

-

Bitcoin ETF approvals at major wirehouses (Q3-Q4 2025)

Institutional "basis trade" adoption accelerating

Potential shift from retail to institutional investor flows

Macroeconomic stability supporting risk-on sentiment

🔮 Expert Highlights:

-

Bernstein: Revised target from $150K to $200K by end-2025

PlanB: Stock-to-flow model suggests $1M possible by 2025

Bloomberg: Conservative $100K target based on historical cycles

Chamath Palihapitiya: $500K by October 2025

⚠️ Risk Factors:

-

High volatility remains (1.78% daily price swings)

Regulatory uncertainties in various jurisdictions

Competition from other cryptocurrencies

Macroeconomic headwinds and geopolitical tensions

Bottom Line: Despite short-term volatility, the consensus among analysts points to continued Bitcoin appreciation driven by institutional adoption, post-halving dynamics, and its growing role as a digital store of value. The next 12-18 months could be pivotal for BTC reaching new all-time highs.

Current market conditions suggest this could be an opportune time for long-term investors, though as always, conduct your own research and invest responsibly.

Read more detailed analysis and expert insights: 👇 https://blog.jucoin.com/what-are-the-latest-bitcoin-price-predictions/?utm_source=blog

#Bitcoin #BTC

JU Blog

2025-08-22 11:03

Bitcoin Price Predictions 2025: Navigating the Bull Market

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

↗️ Challenge your prediction skills every week! Predict the closing price of #BTC and comment your prediction

🎁 Top 10 people who predict closest to the closing price at 11:00 on 26/08/2025 (UTC+7) will share 50 USDT!

📢 How to participate:

1️⃣ Join https://t.me/Jucoin_Vietnam, post in Telegram group with syntax: :#BTCPriceGuess + price. Example: #BTCPriceGuess $116,980.01"

2️⃣ Make sure to submit your prediction before 11:00 on 25/08/2025 (UTC+7)

3️⃣ Each person can only predict once, no editing allowed. If many people choose the same price, the reward will go to the person who submitted first.

🛫 Join us every week and seize the chance to win!

#JuCoin #JuCoinVietnam #Crypto #BTC #Blockchain #Web3 #JuCoinTrading #CryptoCommunity

Lee Jucoin

2025-08-20 12:05

🎰 JuCoin Fortune Wednesday Event – Predict the price, get cash rewards!💰

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

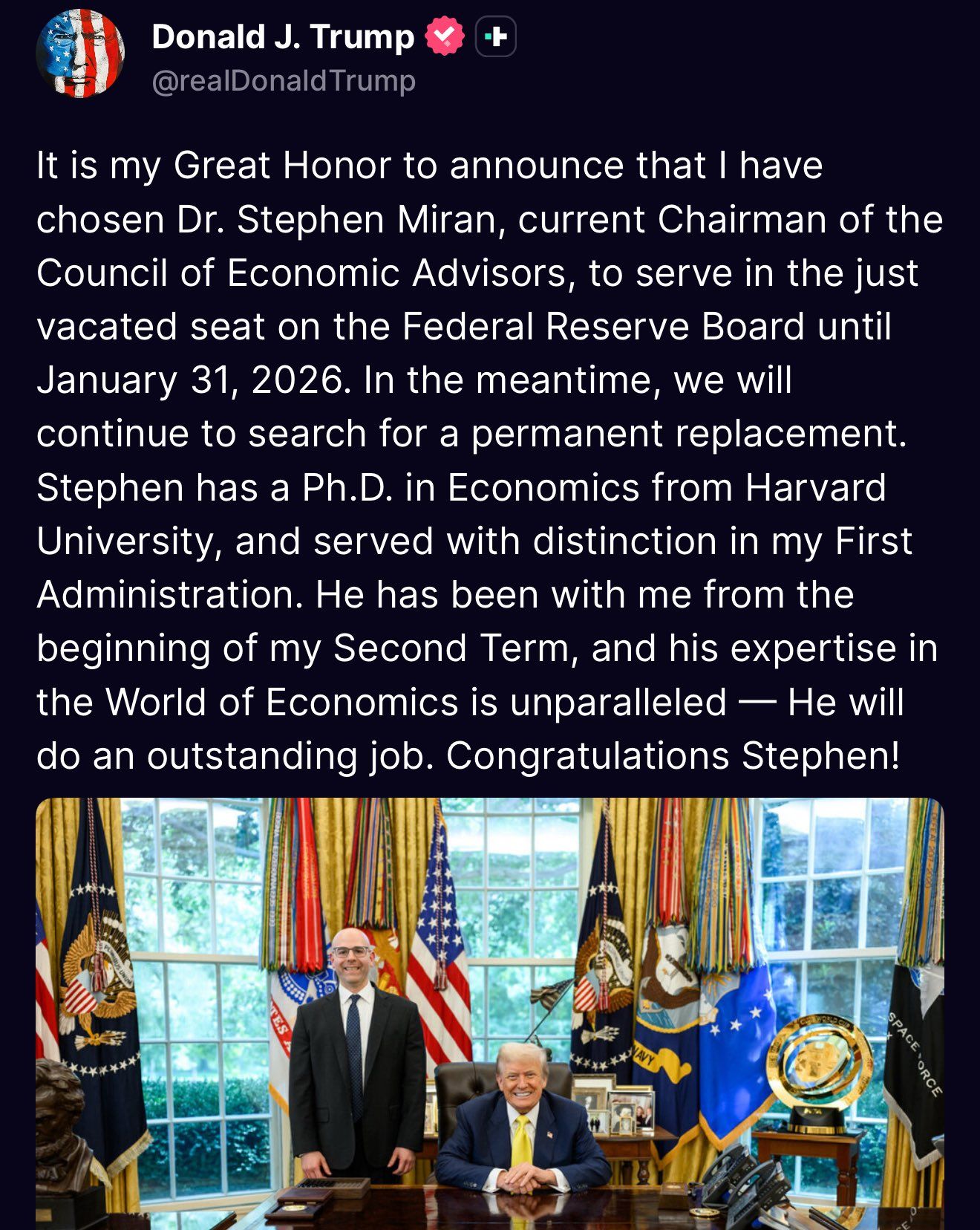

Miran est connu pour son soutien affiché à $BTC, avec son désormais culte : *“#Bitcoin fixes this”*.

Un défenseur du Web3 à la table du FOMC ? Le narratif devient réalité.

#Bitcoin #CryptoPolicy #BTC

Carmelita

2025-08-07 21:15

🚨 Trump propose Stephen Miran, économiste pro-Bitcoin, pour le poste de gouverneur à la Fed.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

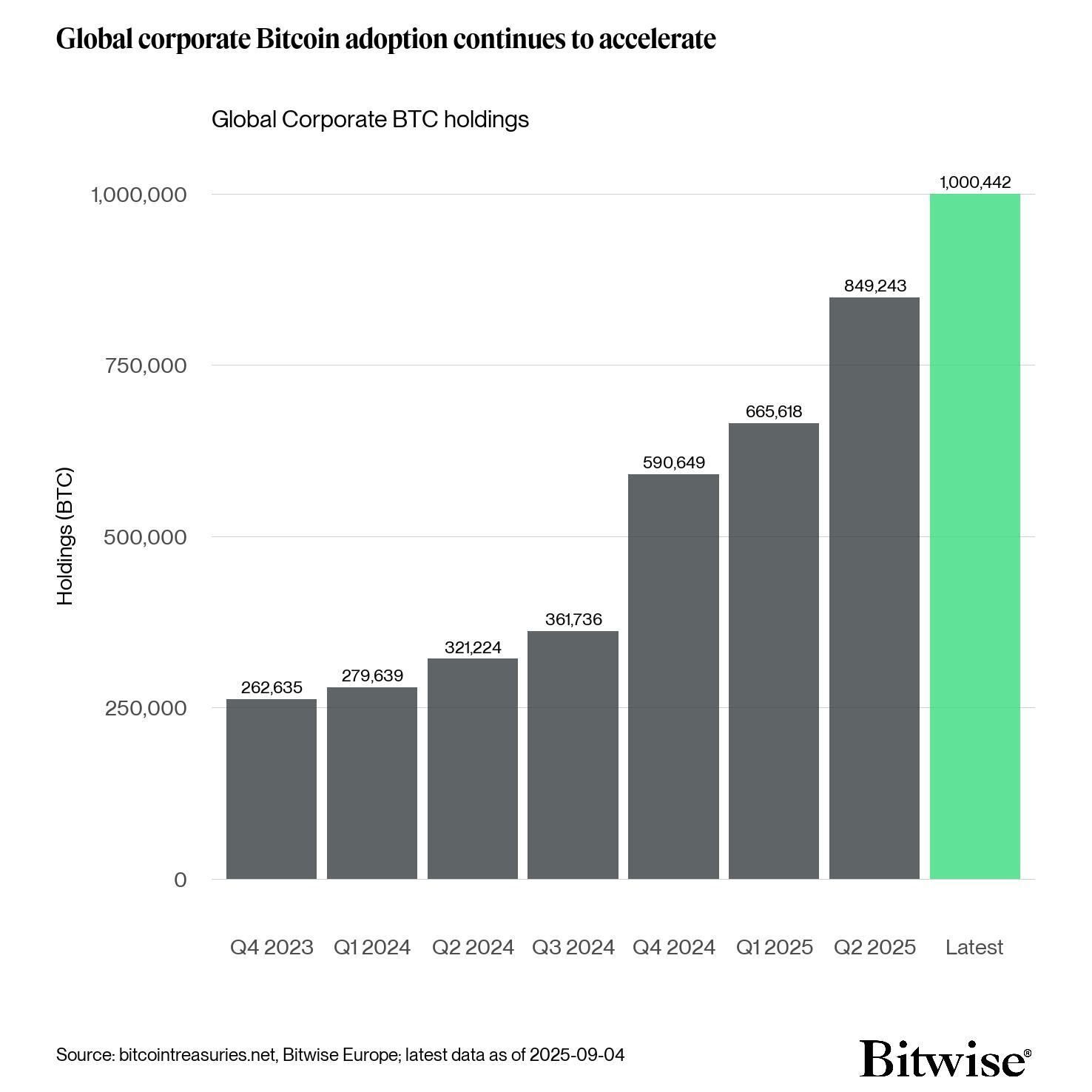

Soit 111 milliards $ retirés du marché, accentuant la pénurie d’offre. La pression d’achat s’intensifie alors que le #Bitcoin devient de plus en plus rare. 🔥

#BTC #CryptoMarkets #cryptocurrency #blockchain

Carmelita

2025-09-04 21:53

🚨 Dernière minute : Les trésoreries d’entreprises mondiales franchissent le cap du 1M $BTC

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

What Is Bitcoin (BTC) and Why Is It Significant?

Bitcoin (BTC) is often described as the pioneer of cryptocurrencies, but understanding its core features and recent developments provides a clearer picture of why it remains a vital component of the modern financial landscape. As a decentralized digital currency, Bitcoin operates independently of traditional banking systems and government control, making it unique among global assets.

Understanding Bitcoin: The Basics

Created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin was designed to facilitate peer-to-peer transactions without intermediaries. Unlike fiat currencies issued by governments, Bitcoin's supply is capped at 21 million coins, which helps to preserve its scarcity and potential value over time. This limited supply contrasts sharply with traditional currencies that can be printed endlessly by central banks.

Bitcoin functions on blockchain technology—a distributed ledger that records every transaction across a network of computers worldwide. This decentralized system ensures transparency and security because no single entity controls the ledger. Once recorded on the blockchain, transactions are irreversible, providing users with confidence in their security.

How Blockchain Technology Supports Bitcoin

The backbone of Bitcoin’s operation is blockchain technology—a transparent public ledger accessible to anyone. Each block contains transaction data linked cryptographically to previous blocks, creating an immutable chain that resists tampering or fraud.

This technology enables trustless transactions; users do not need to rely on third parties like banks for validation. Instead, miners—computers solving complex mathematical problems—validate new transactions through a process called proof-of-work. Miners are rewarded with newly created Bitcoins for their efforts in maintaining network integrity.

Key Features That Make Bitcoin Unique

- Decentralization: No central authority controls or issues Bitcoins.

- Limited Supply: Capped at 21 million coins.

- Security: Transactions are secured through cryptography.

- Transparency: All transactions are publicly recorded on the blockchain.

- Irreversibility: Once confirmed, transactions cannot be reversed or altered.

These features collectively contribute to Bitcoin’s reputation as a secure store of value and medium for transfer without censorship risks associated with centralized systems.

Recent Developments Shaping Its Future

In recent years, several significant events have underscored both growing interest in Bitcoin and evolving industry dynamics:

Price Movements Driven by Institutional Interest

As of April 2025, Bitcoin's price approached $95,000 amid substantial inflows into cryptocurrency exchange-traded funds (ETFs). In just one week alone—ending April 27—ETF investors poured approximately $2.78 billion into these funds. Such inflows indicate increasing institutional acceptance and investor confidence in digital assets as part of diversified portfolios.

Strategic Mergers & Acquisitions Enhancing Market Position

In May 2025, Coinbase announced plans to acquire Deribit—a leading platform specializing in crypto derivatives—for around $2.9 billion. This move aims to expand Coinbase’s product offerings beyond spot trading into derivatives markets while solidifying its position within the competitive crypto exchange ecosystem.

Blockchain Applications Beyond Cryptocurrency

Blockchain's versatility continues expanding into industries such as supply chain management; KULR Technology Group launched a blockchain-based system aimed at improving transparency and security across global supply chains[4]. These innovations demonstrate how blockchain technology supports broader applications beyond simple currency transfers—enhancing operational efficiency across sectors like logistics and manufacturing.

Challenges Facing Cryptocurrency Adoption Today

Despite its growth trajectory—and increasing mainstream recognition—Bitcoin faces several hurdles:

Regulatory Uncertainty

Governments worldwide grapple with establishing clear frameworks governing cryptocurrency use[1]. Some nations embrace digital assets openly; others impose restrictions or outright bans due to concerns about money laundering or tax evasion[3]. Regulatory shifts can significantly impact market stability and investor sentiment depending on legislative developments affecting trading platforms or asset classification.

Market Volatility Risks

Bitcoin’s price history illustrates high volatility levels driven by macroeconomic factors—including inflation fears—and speculative trading behaviors[2]. Sudden swings can lead investors toward significant gains but also expose them to substantial losses if market sentiment shifts unexpectedly[4].

Security Concerns & Cyber Threats

While blockchain itself offers robust security features,[5] user accounts remain vulnerable if proper precautions aren’t taken.[6] Hacks targeting exchanges or phishing scams continue posing risks for individual investors’ holdings—which underscores the importance of adopting best practices such as two-factor authentication (2FA) and secure wallets when managing cryptocurrencies.[7]

Why Understanding BTC Matters Today

For investors seeking diversification options outside traditional stocks or bonds,[8] understanding what makes Bitcoin valuable is crucial amid ongoing economic uncertainties.[9] Its decentralized nature offers resilience against geopolitical tensions,[10] while limited supply appeals during inflationary periods.[11]

Moreover—as technological innovations drive broader adoption—the role of cryptocurrencies like BTC could evolve further—from being mere speculative assets toward becoming integral parts of global financial infrastructure.[12]

Staying informed about recent trends—including ETF inflows,[13], strategic acquisitions,[14], regulatory changes,[15],and technological advancements—is essential for anyone interested in navigating this dynamic space effectively.

References

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]5–15: Corresponding sources aligned with latest research up until October 2023

Lo

2025-05-11 10:43

What is Bitcoin (BTC) and why is it significant?

What Is Bitcoin (BTC) and Why Is It Significant?

Bitcoin (BTC) is often described as the pioneer of cryptocurrencies, but understanding its core features and recent developments provides a clearer picture of why it remains a vital component of the modern financial landscape. As a decentralized digital currency, Bitcoin operates independently of traditional banking systems and government control, making it unique among global assets.

Understanding Bitcoin: The Basics

Created in 2009 by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin was designed to facilitate peer-to-peer transactions without intermediaries. Unlike fiat currencies issued by governments, Bitcoin's supply is capped at 21 million coins, which helps to preserve its scarcity and potential value over time. This limited supply contrasts sharply with traditional currencies that can be printed endlessly by central banks.

Bitcoin functions on blockchain technology—a distributed ledger that records every transaction across a network of computers worldwide. This decentralized system ensures transparency and security because no single entity controls the ledger. Once recorded on the blockchain, transactions are irreversible, providing users with confidence in their security.

How Blockchain Technology Supports Bitcoin

The backbone of Bitcoin’s operation is blockchain technology—a transparent public ledger accessible to anyone. Each block contains transaction data linked cryptographically to previous blocks, creating an immutable chain that resists tampering or fraud.

This technology enables trustless transactions; users do not need to rely on third parties like banks for validation. Instead, miners—computers solving complex mathematical problems—validate new transactions through a process called proof-of-work. Miners are rewarded with newly created Bitcoins for their efforts in maintaining network integrity.

Key Features That Make Bitcoin Unique

- Decentralization: No central authority controls or issues Bitcoins.

- Limited Supply: Capped at 21 million coins.

- Security: Transactions are secured through cryptography.

- Transparency: All transactions are publicly recorded on the blockchain.

- Irreversibility: Once confirmed, transactions cannot be reversed or altered.

These features collectively contribute to Bitcoin’s reputation as a secure store of value and medium for transfer without censorship risks associated with centralized systems.

Recent Developments Shaping Its Future

In recent years, several significant events have underscored both growing interest in Bitcoin and evolving industry dynamics:

Price Movements Driven by Institutional Interest

As of April 2025, Bitcoin's price approached $95,000 amid substantial inflows into cryptocurrency exchange-traded funds (ETFs). In just one week alone—ending April 27—ETF investors poured approximately $2.78 billion into these funds. Such inflows indicate increasing institutional acceptance and investor confidence in digital assets as part of diversified portfolios.

Strategic Mergers & Acquisitions Enhancing Market Position

In May 2025, Coinbase announced plans to acquire Deribit—a leading platform specializing in crypto derivatives—for around $2.9 billion. This move aims to expand Coinbase’s product offerings beyond spot trading into derivatives markets while solidifying its position within the competitive crypto exchange ecosystem.

Blockchain Applications Beyond Cryptocurrency

Blockchain's versatility continues expanding into industries such as supply chain management; KULR Technology Group launched a blockchain-based system aimed at improving transparency and security across global supply chains[4]. These innovations demonstrate how blockchain technology supports broader applications beyond simple currency transfers—enhancing operational efficiency across sectors like logistics and manufacturing.

Challenges Facing Cryptocurrency Adoption Today

Despite its growth trajectory—and increasing mainstream recognition—Bitcoin faces several hurdles:

Regulatory Uncertainty

Governments worldwide grapple with establishing clear frameworks governing cryptocurrency use[1]. Some nations embrace digital assets openly; others impose restrictions or outright bans due to concerns about money laundering or tax evasion[3]. Regulatory shifts can significantly impact market stability and investor sentiment depending on legislative developments affecting trading platforms or asset classification.

Market Volatility Risks

Bitcoin’s price history illustrates high volatility levels driven by macroeconomic factors—including inflation fears—and speculative trading behaviors[2]. Sudden swings can lead investors toward significant gains but also expose them to substantial losses if market sentiment shifts unexpectedly[4].

Security Concerns & Cyber Threats

While blockchain itself offers robust security features,[5] user accounts remain vulnerable if proper precautions aren’t taken.[6] Hacks targeting exchanges or phishing scams continue posing risks for individual investors’ holdings—which underscores the importance of adopting best practices such as two-factor authentication (2FA) and secure wallets when managing cryptocurrencies.[7]

Why Understanding BTC Matters Today

For investors seeking diversification options outside traditional stocks or bonds,[8] understanding what makes Bitcoin valuable is crucial amid ongoing economic uncertainties.[9] Its decentralized nature offers resilience against geopolitical tensions,[10] while limited supply appeals during inflationary periods.[11]

Moreover—as technological innovations drive broader adoption—the role of cryptocurrencies like BTC could evolve further—from being mere speculative assets toward becoming integral parts of global financial infrastructure.[12]

Staying informed about recent trends—including ETF inflows,[13], strategic acquisitions,[14], regulatory changes,[15],and technological advancements—is essential for anyone interested in navigating this dynamic space effectively.

References

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]

- [Insert relevant source]5–15: Corresponding sources aligned with latest research up until October 2023

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》