$BTC/USDT vient de clôturer au-dessus de $111K. 👉 Les analystes fixent le pire scénario à ~$100K (-10%).

⚡ Petit rappel historique : lors des cycles passés, Bitcoin encaissait des corrections de 30–40% avant de repartir en orbite.

➡️ Si -10% est désormais le maximum de douleur… alors les taureaux mènent la danse.

#Bitcoin #BTC #crypto #CryptoMarkets

Carmelita

2025-09-07 22:38

📊 Bitcoin bulls flexing their dominance

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

$BTC/USDT

🇸🇻 NEW: Président Nayib Bukele annonce qu’El Salvador achètera 1 Bitcoin par jour 💥

👉 Jusqu’à ce que le BTC devienne “inabordable avec les monnaies fiat.”

Une stratégie long terme qui pourrait redéfinir le rôle des États dans l’adoption #Bitcoin .

#BTC #ElSalvador #crypto #cryptocurrency #

Carmelita

2025-09-07 12:44

🇸🇻 NEW: Président Nayib Bukele annonce qu’El Salvador achètera 1 Bitcoin par jour 💥

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

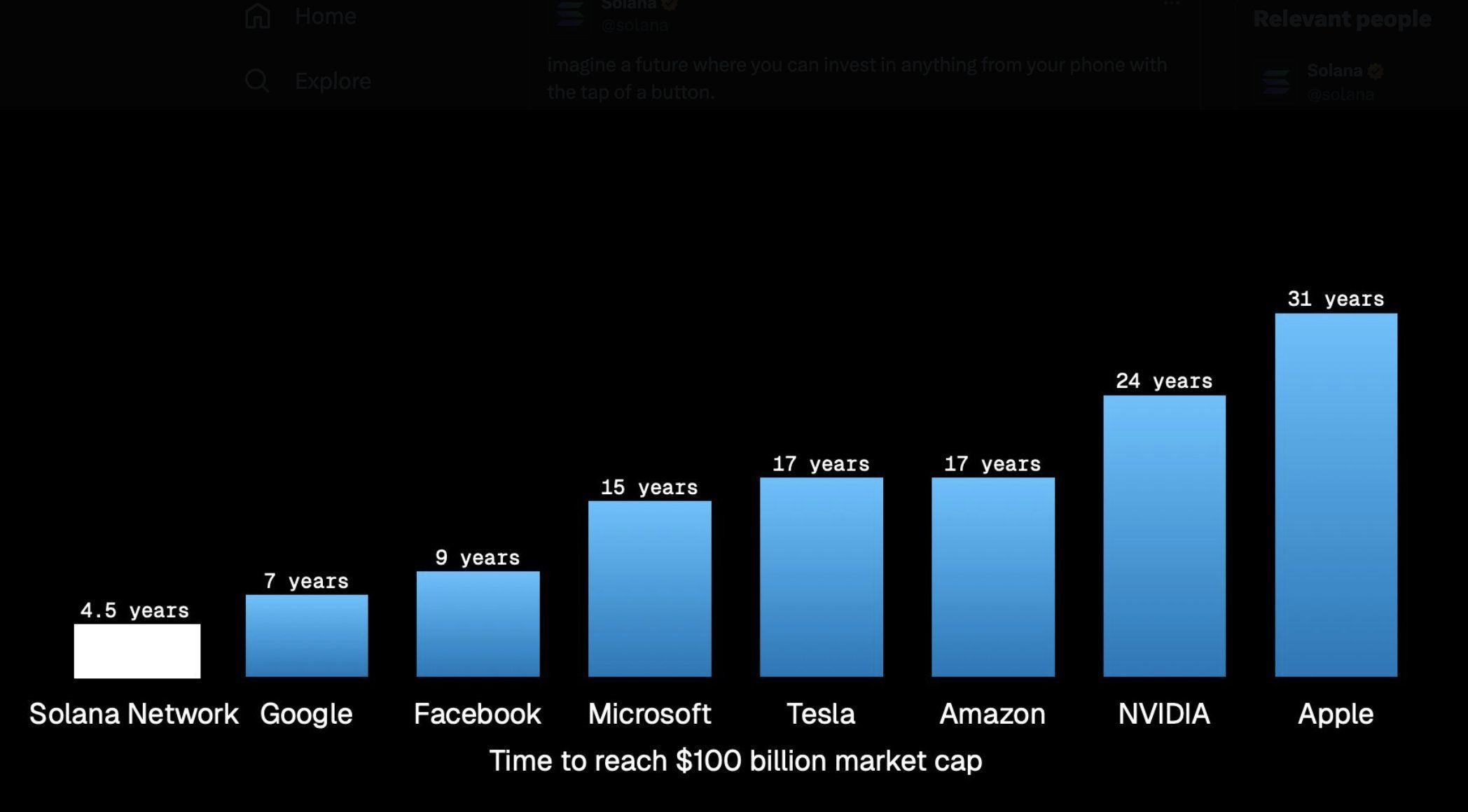

De 0 à +100 milliards $ en valeur d’écosystème en moins de 5 ans — l’une des plus fulgurantes histoires de croissance de la crypto. 👀

$SOL/USDT peut-il encore aller ?

#Solana #crypto #cryptocurrency #blockchain

Carmelita

2025-09-06 16:47

⚡ Solana en mode fusée 🚀

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

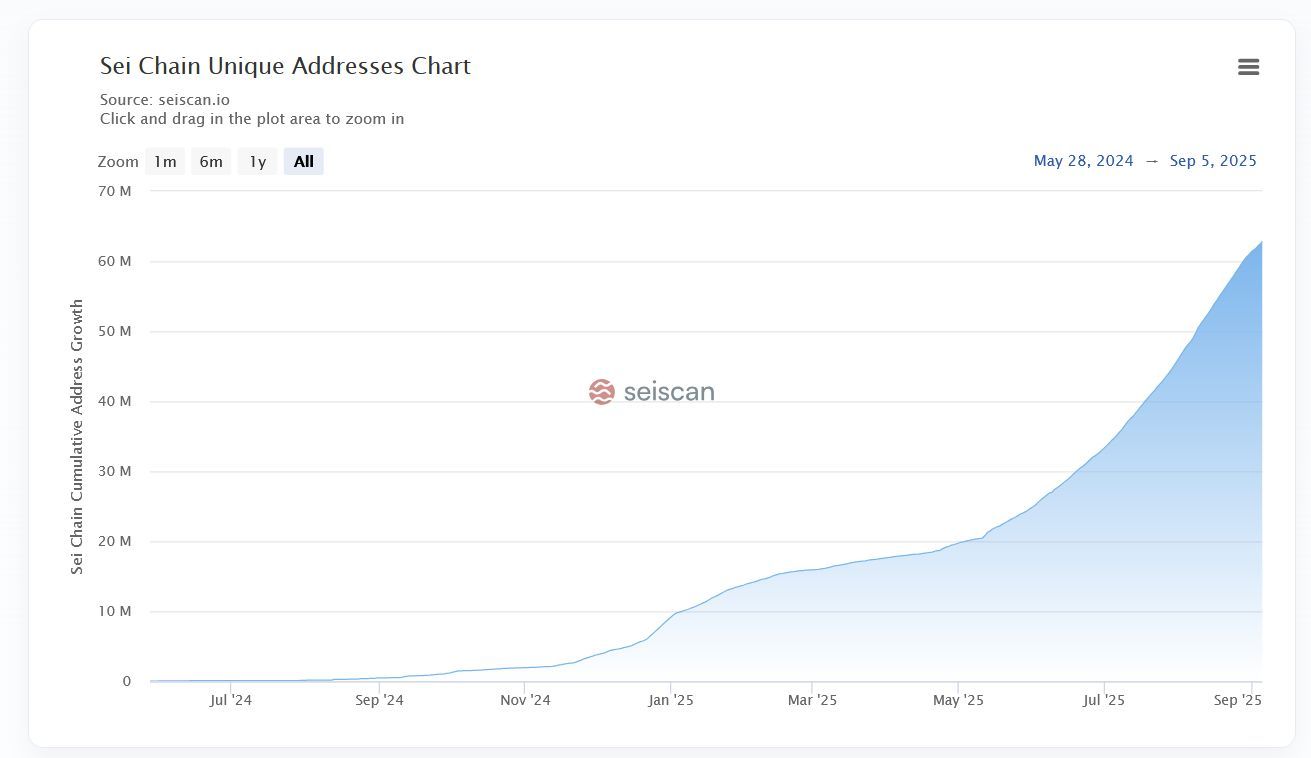

+14M nouvelles adresses en 1 mois Avec un record absolu de 715,814 wallets créés en une seule journée (9 août 2025).

$SEI/USDT ? 👀

#SEI #crypto #cryptocurrency #blockchain

Carmelita

2025-09-06 16:37

📈 SEI explose son adoption !

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

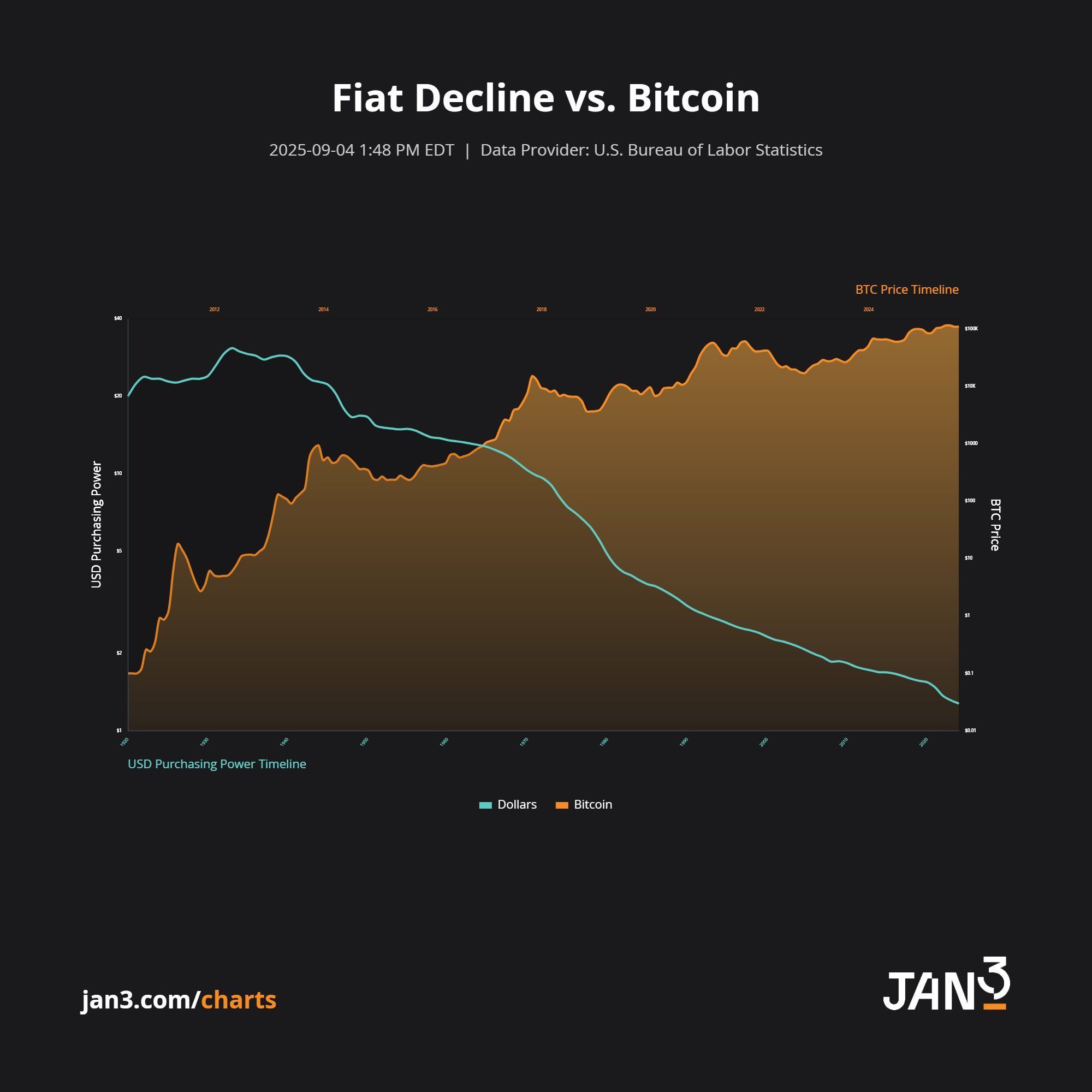

FACT: Les monnaies fiat perdent sans cesse de leur pouvoir d’achat… tandis que #Bitcoin ne cesse de grimper. 💪

📊 La tendance est limpide : ❌ Déclin du fiat ✅ Puissance du $BTC

La vraie question : combien de temps avant que Bitcoin devienne la référence monétaire mondiale ? 👀

#crypto #Bitcoin #cryptocurrency #blockchain

Carmelita

2025-09-06 16:40

🚨 FACT: Les monnaies fiat perdent sans cesse de leur pouvoir d’achat… tandis que #Bitcoin ne cesse

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

Chaque hausse = victoire signée par la communauté 💎🙌

💬 Team hodl ou team FOMO ? #JuCoin #crypto #ATH #Bullish

Carmelita

2025-08-19 13:36

🔥 $JU frappe un nouvel ATH : 19$ !

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

Découvrez OnChain – la façon la plus rapide de trader les nouveaux projets et actifs émergents

✅ Exécution ultra-rapide ✅ Flexibilité maximale ✅ Tradez directement avec votre compte JuCoin – pas de wallet requis

https://www.jucoin.com/en/onchain/ #JuCoin #crypto #Web3 #EarlyAccess

Carmelita

2025-08-21 15:31

Envie de profiter des opportunités en avant-première ?

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

Gagne $100 en $YZY – 5 gagnants à se partager le lot

✅ Commente ton UID ✅ Remplis le formulaire 👉 https://gleam.io/lOPaN/join-to-win-100-worth-of-yzy

⏰ 48h pour participer ⚡ Ne rate pas ta chance ! #YZY #crypto #Giveaway #Airdrop

Carmelita

2025-08-21 14:43

🎁 Giveaway Alert! 💙

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

💡 Idées → déployées en secondes 👤 Utilisateurs → onboarding sans friction 🌱 Croissance → 100M$ pour l’écosystème

Ce n’est pas un rêve, c’est #JuChain aujourd’hui 🚀

Builders, rêveurs, leaders de communautés : Le futur n’attend pas — et vous non plus.

🔗 https://www.juchain.org/en/developer-support #Web3 #crypto #BUIDL #JuChain

Carmelita

2025-08-21 14:49

JuChain Genesis Ark Program

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

$JU Savings arrive demain ! Ne clignez pas des yeux — saisissez-le. verrouillez-le. faites-le croître. https://jucoin.online/en/accounts/register?ref=USJYGL

Carmelita

2025-09-01 22:54

Tick. Tock.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

🔍 David Schwartz (CTO) rappelle que :

• Ripple opère moins de **1% des validateurs**

• Les évolutions de XRPL dépendent du **consensus communautaire**

• Les milliards en escrow sont **verrouillés par smart contracts**, sans accès direct

👉 Une piqûre de rappel importante sur la gouvernance réelle des protocoles.

#XRP #crypto #cryptocurrency

Carmelita

2025-08-07 14:15

🚨 Fin des fantasmes : Ripple ne contrôle pas le $XRP Ledger.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

Lo

2025-05-15 02:38

What is sharding in blockchain?

What Is Sharding in Blockchain?

Sharding is a transformative scalability solution designed to enhance the performance and efficiency of blockchain networks. As blockchain technology gains widespread adoption, the need to process increasing numbers of transactions quickly and securely becomes critical. Sharding addresses this challenge by dividing the entire network into smaller, manageable segments called shards, each capable of processing transactions independently. This division allows multiple transactions to be processed simultaneously, significantly reducing congestion and improving overall throughput.

In essence, sharding enables a blockchain network to operate more like a distributed database rather than a single monolithic ledger. Each shard functions as its own mini-blockchain with its unique state and transaction history but remains interconnected within the larger network framework. This structure not only boosts transaction speeds but also helps in scaling blockchain solutions for real-world applications such as decentralized finance (DeFi), supply chain management, and enterprise solutions.

How Does Sharding Work in Blockchain Networks?

The core idea behind sharding involves splitting the workload across various smaller components—shards—that work concurrently. Each shard processes a subset of all transactions based on specific criteria such as user accounts or data types. For example, one shard might handle payment transactions while another manages smart contract interactions.

To maintain consistency across these independent shards, mechanisms like cross-shard communication are implemented. These protocols ensure that when users perform transactions involving multiple shards—say transferring assets from one account managed by one shard to another managed by different shards—the system can verify and record these operations accurately without compromising security or integrity.

Shards typically operate as separate blockchains known as "shard chains." They maintain their own states—such as account balances or smart contract data—and process their designated set of transactions independently before periodically syncing with other shards through consensus protocols designed for cross-shard validation.

Types of Sharding

There are primarily two types of sharding used in blockchain systems:

Horizontal Sharding: This approach divides the network based on transaction types or user groups—for instance, separating payment processing from smart contract execution.

Vertical Sharding: Here, data is partitioned based on storage needs or data categories—for example, storing different kinds of information (user profiles vs transactional logs) separately across various shards.

Both methods aim to optimize resource utilization while maintaining security and decentralization principles inherent in blockchain technology.

Benefits of Implementing Sharding

Implementing sharding offers several significant advantages:

Enhanced Scalability: By distributing transaction loads across multiple shards, networks can handle many more operations per second compared to traditional single-chain architectures.

Reduced Transaction Fees: Faster processing times mean less congestion; consequently, users often experience lower fees during peak usage periods.

Improved Network Efficiency: Smaller nodes manage fewer tasks within each shard—they require less computational power and storage capacity—making participation easier for more validators.

Parallel Processing: Multiple parts of the network work simultaneously rather than sequentially; this parallelism accelerates overall throughput significantly.

These benefits make sharded blockchains suitable for large-scale applications where high speed and low latency are essential requirements.

Challenges Associated With Blockchain Sharding

Despite its promising potential, implementing sharding introduces complex technical challenges that must be addressed:

Inter-Shard Communication

Ensuring seamless communication between different shards is vital yet difficult. Transactions involving multiple shards require secure protocols that prevent double-spending or inconsistencies—a problem known as cross-shard communication complexity.

Consensus Mechanisms Across Multiple Shards

Traditional consensus algorithms like Proof-of-Work (PoW) are not inherently designed for multi-shard environments. Developing efficient consensus models that work reliably across numerous independent chains remains an ongoing research area within blockchain development communities.

Security Concerns

Dividing a network into smaller segments increases vulnerability risks; if one shard becomes compromised due to an attack or bug exploitation—a scenario called "shard takeover"—it could threaten the entire ecosystem's security integrity unless robust safeguards are implemented effectively throughout all parts of the system.

Standardization & Adoption Barriers

For widespread adoption beyond experimental phases requires industry-wide standards governing how sharded networks communicate and interoperate seamlessly. Without standardization efforts among developers and stakeholders worldwide—including major platforms like Ethereum—the risk exists that fragmentation could hinder progress rather than accelerate it.

Recent Developments in Blockchain Sharding Technology

Major projects have made notable strides toward integrating sharding into their ecosystems:

Ethereum 2.0 has been at the forefront with plans for scalable upgrades through its phased rollout strategy involving beacon chains (launched December 2020). The next steps include deploying dedicated shard chains alongside cross-shard communication protocols aimed at enabling Ethereum’s massive ecosystem to scale efficiently without sacrificing decentralization or security standards.

Polkadot employs relay chains connecting parachains—independent blockchains optimized for specific use cases—that communicate via shared security models facilitating interoperability among diverse networks.

Cosmos, utilizing Tendermint Core consensus algorithm architecture allows developers to create zones (independent blockchains) capable of interoperation within an overarching hub-and-spoke model similar to Polkadot’s relay chain approach.

Research continues globally exploring innovative techniques such as state sharding, which aims at optimizing how state information is stored across nodes—a crucial factor influencing scalability limits further improvements.

Potential Risks Impacting Future Adoption

While promising solutions exist today—and ongoing research promises even better approaches—the path forward faces hurdles related mainly to:

Security Risks: Smaller individual shards may become targets due to reduced validation power compared with full nodes operating on entire networks.

Interoperability Challenges: Achieving flawless interaction between diverse systems requires standardized protocols; otherwise fragmentation may occur leading toward isolated ecosystems instead of unified platforms.

Adoption Hurdles & Industry Standardization

Without broad agreement on technical standards governing cross-shard communications—as well as regulatory considerations—widespread deployment might slow down considerably despite technological readiness.

Understanding How Blockchain Scaling Evolves Through Sharding

As demand grows exponentially—from DeFi applications demanding rapid trades versus enterprise-level integrations requiring high throughput—the importance lies not just in creating faster blockchains but ensuring they remain secure against evolving threats while interoperable enough for global adoption.

By addressing current limitations through continuous innovation—in protocol design improvements like state sharing techniques—and fostering collaboration among industry leaders worldwide who develop open standards —the future landscape looks promising: scalable yet secure decentralized systems capable enough for mainstream use.

This comprehensive overview provides clarity about what sharding entails within blockchain technology: how it works technically; why it matters; what benefits it offers; what challenges lie ahead; along with recent advancements shaping its future trajectory—all aligned towards helping users understand both foundational concepts and cutting-edge developments effectively.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

Début de mois = possible dip 📉 2ᵉ moitié = éventuelle étincelle si la Fed coupe les taux 🔥

👉 Septembre pourrait être le mois pour se positionner avant le prochain leg haussier. 🚀

#Ethereum #crypto

Carmelita

2025-08-30 23:40

$ETH – Septembre en ligne de mire

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

👀 Les regards sont braqués sur $0.20 comme zone d’accumulation idéale.

✅ R/R setup explosif : les acheteurs pourraient déclencher le breakout attendu. 🚀

👉 Tu stackes $HBAR ou tu attends le décollage ?

#HBAR #crypto

Carmelita

2025-08-30 23:41

$HBAR se resserre dans une zone clé de volume.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

Future Challenges for Global Crypto Adoption

As the world increasingly integrates digital currencies into everyday life, understanding the hurdles that could impede widespread crypto adoption becomes essential. While blockchain technology and cryptocurrencies have made significant strides, several persistent challenges threaten to slow or even halt their mainstream acceptance. This article explores these obstacles in detail, providing insights into regulatory, security, market, infrastructural, educational, environmental, and scalability issues that lie ahead.

Regulatory Uncertainty and Its Impact on Cryptocurrency Growth

One of the most significant barriers to global crypto adoption is the lack of clear and consistent regulatory frameworks across different jurisdictions. Countries vary widely in how they approach digital assets—some embrace cryptocurrencies with open arms; others impose strict bans or ambiguous rules. This patchwork creates a landscape fraught with legal ambiguity for investors and businesses alike.

Recent developments highlight this ongoing uncertainty. For instance, in April 2025, the U.S. Securities and Exchange Commission (SEC) issued a statement clarifying its stance on digital asset regulation—a move met with mixed reactions from industry stakeholders. Such regulatory ambiguity can deter institutional investors who seek clarity before committing substantial capital to crypto markets.

The absence of comprehensive regulations can lead to legal risks for companies operating within this space—potentially resulting in fines or shutdowns—and discourage mainstream financial institutions from integrating cryptocurrencies into their services. As governments worldwide continue to refine their policies on digital assets, achieving a balanced framework that fosters innovation while ensuring consumer protection remains a critical challenge.

Security Concerns Eroding Trust in Digital Assets

Security remains at the forefront of concerns surrounding cryptocurrency adoption. Despite advancements in blockchain security protocols, high-profile hacks continue to undermine confidence among users and potential adopters.

In March 2025 alone, a major cryptocurrency exchange suffered a significant breach resulting in millions of dollars worth of digital assets being stolen. Such incidents not only cause immediate financial losses but also damage long-term trust in crypto platforms' safety measures.

For broader acceptance—especially among institutional investors—the security infrastructure must be robust enough to prevent future breaches. Ongoing efforts include implementing multi-signature wallets, decentralized exchanges with enhanced security features—and increasing transparency around cybersecurity practices are vital steps forward.

Failure to address these concerns could lead users toward more traditional financial systems or alternative investments perceived as safer options—hindering overall growth within the cryptocurrency ecosystem.

Market Volatility as an Adoption Barrier

Cryptocurrency markets are notorious for their extreme price fluctuations over short periods—a characteristic that can deter both individual traders and large-scale enterprises from embracing digital currencies fully.

In early 2025 alone, Bitcoin and Ethereum experienced substantial swings causing major losses for some investors; Strategy (formerly MicroStrategy), which holds large Bitcoin reserves as part of its corporate strategy reported a $4.2 billion net loss due to volatile price movements during Q1 2025.

This volatility complicates use cases such as daily transactions or business payments where stable value is crucial. Companies may hesitate to accept cryptocurrencies if they fear rapid devaluation affecting profitability or operational costs significantly.

To mitigate this issue:

- Stablecoins pegged against fiat currencies are gaining popularity.

- Derivative products offer hedging options.

- Developing more mature markets with higher liquidity can reduce volatility over time.However—as long as speculative trading dominates crypto markets—the risk associated with sudden price swings will remain an obstacle for mass adoption.

Infrastructure Development: Building Reliable Payment Ecosystems

A well-developed infrastructure is fundamental for seamless cryptocurrency transactions—from user-friendly wallets to integrated payment systems capable of handling high transaction volumes efficiently.

Recent initiatives demonstrate progress: In April 2025 , firms like Cantor Financial Group partnered with Tether and SoftBank launching Twenty One Capital—aimingto become oneoftheworld’s largest bitcoin treasuries—which underscores ongoing efforts toward infrastructure expansion[3].

Despite such developments:

- Many regions still lack reliable payment gateways supporting cryptocurrencies.

- Transaction speeds remain inconsistent across networks.

- High fees during peak times hinder usability at scale.These limitations restrict everyday use cases like retail shopping or remittances—key drivers needed for mainstream acceptance—and highlight areas requiring further technological innovation such as layer 2 scaling solutions (e.g., Lightning Network)and sharding techniquesto improve throughputand reduce costs .

Education Gaps Hindering Broader Public Understanding

A significant portion of potential users still lacks foundational knowledge about how cryptocurrencies work—including blockchain technology's benefits versus risks—which hampers wider acceptance beyond tech-savvy communities .

Efforts are underway globally through educational campaigns aimed at demystifying cryptos’ mechanicsand promoting responsible investing practices . Nonetheless , misconceptions persist regarding issues like decentralization , privacy , taxation,and environmental impact .

Bridging this knowledge gap is crucial because informed consumers tendto make better decisions —whether adopting new payment methodsor investing responsibly —ultimately fostering trustand encouraging broader participationincryptocurrency ecosystems .

Environmental Concerns Affecting Regulatory Policies

The energy consumption associated with mining certain proof-of-work cryptocurrencies has sparked environmental debates worldwide . Critics argue that large-scale mining operations consume vast amountsof electricity —sometimes sourcedfrom fossil fuels—raising sustainability questions .

Some countries have responded by exploring greener alternatives:

- Transitioning towards renewable energy-powered mining farms

- Promoting proof-of-stake consensus mechanisms which require less energyNegative perceptions about environmental impact could influence future regulations , potentially leading tomore restrictive policiesthat limit mining activitiesor impose carbon taxeson miners[6].

Addressing these concerns involves balancing technological innovationwith ecological responsibility—to ensure sustainable growth without compromising environmental integrity .

Scalability Challenges Limiting Transaction Capacity

As demand increases,the current capacity limitsof many blockchain networks become apparent . High transaction feesand slow confirmation times during peak periods hinder practical usage scenarios like retail paymentsor microtransactions .

Research teams are actively working on solutions:1.Layer 2 scaling solutionssuch as state channelsand sidechains aimto offload transactionsfrom main chains .2.Sharding techniques distribute network loadacross multiple segmentsfor increased throughput .3.Blockchain interoperability protocols facilitate communication between different networks,to create unified ecosystems capableof handling larger volumes seamlessly[7].

Without effective scalability improvements,this bottleneck could resultin user frustration,reduced transaction speed,and higher costs—all factors discouraging mass adoption across diverse sectors including finance,e-commerce,and remittances.

Navigating Future Pathways Toward Widespread Adoption

Overcoming these multifaceted challenges requires coordinated efforts among regulators,businesses,and technologists alike.To foster trust,safety,and efficiency within cryptocurrency ecosystems,the industry must prioritize transparent regulation development,enforce rigorous security standards,and invest heavilyin infrastructural upgrades alongwith public education initiatives .

Furthermore,the evolution towards sustainable practices addressing environmental impacts will be critical—not only ethically but also politically—to avoid restrictive legislation that might stifle innovation.[8] As research progresseson scalability solutions,the promise remains high: creating faster,morereliable,inclusivecrypto networks capableof supporting global economic integration.

Final Thoughts

While numerous hurdles stand between current state-of-the-art blockchain applicationsand full-fledged global crypto adoption,it’s evident that proactive strategies targeting regulation clarity,safety enhancements,infrastructure robustness,population education,sustainability measures,and scalable technology development will shape future success stories . The path forward involves collaborative effortsto unlockcryptocurrencies’ transformative potential while mitigating risks inherent within emerging technologies.

References

1. [Link]

2. [Link]

3. [Link]

4. [Link]

5. [Link]

6. [Link]

7. [Link]

8. [Link]

JCUSER-WVMdslBw

2025-05-11 14:02

What are the future challenges for global crypto adoption?

Future Challenges for Global Crypto Adoption

As the world increasingly integrates digital currencies into everyday life, understanding the hurdles that could impede widespread crypto adoption becomes essential. While blockchain technology and cryptocurrencies have made significant strides, several persistent challenges threaten to slow or even halt their mainstream acceptance. This article explores these obstacles in detail, providing insights into regulatory, security, market, infrastructural, educational, environmental, and scalability issues that lie ahead.

Regulatory Uncertainty and Its Impact on Cryptocurrency Growth

One of the most significant barriers to global crypto adoption is the lack of clear and consistent regulatory frameworks across different jurisdictions. Countries vary widely in how they approach digital assets—some embrace cryptocurrencies with open arms; others impose strict bans or ambiguous rules. This patchwork creates a landscape fraught with legal ambiguity for investors and businesses alike.

Recent developments highlight this ongoing uncertainty. For instance, in April 2025, the U.S. Securities and Exchange Commission (SEC) issued a statement clarifying its stance on digital asset regulation—a move met with mixed reactions from industry stakeholders. Such regulatory ambiguity can deter institutional investors who seek clarity before committing substantial capital to crypto markets.

The absence of comprehensive regulations can lead to legal risks for companies operating within this space—potentially resulting in fines or shutdowns—and discourage mainstream financial institutions from integrating cryptocurrencies into their services. As governments worldwide continue to refine their policies on digital assets, achieving a balanced framework that fosters innovation while ensuring consumer protection remains a critical challenge.

Security Concerns Eroding Trust in Digital Assets

Security remains at the forefront of concerns surrounding cryptocurrency adoption. Despite advancements in blockchain security protocols, high-profile hacks continue to undermine confidence among users and potential adopters.

In March 2025 alone, a major cryptocurrency exchange suffered a significant breach resulting in millions of dollars worth of digital assets being stolen. Such incidents not only cause immediate financial losses but also damage long-term trust in crypto platforms' safety measures.

For broader acceptance—especially among institutional investors—the security infrastructure must be robust enough to prevent future breaches. Ongoing efforts include implementing multi-signature wallets, decentralized exchanges with enhanced security features—and increasing transparency around cybersecurity practices are vital steps forward.

Failure to address these concerns could lead users toward more traditional financial systems or alternative investments perceived as safer options—hindering overall growth within the cryptocurrency ecosystem.

Market Volatility as an Adoption Barrier

Cryptocurrency markets are notorious for their extreme price fluctuations over short periods—a characteristic that can deter both individual traders and large-scale enterprises from embracing digital currencies fully.

In early 2025 alone, Bitcoin and Ethereum experienced substantial swings causing major losses for some investors; Strategy (formerly MicroStrategy), which holds large Bitcoin reserves as part of its corporate strategy reported a $4.2 billion net loss due to volatile price movements during Q1 2025.

This volatility complicates use cases such as daily transactions or business payments where stable value is crucial. Companies may hesitate to accept cryptocurrencies if they fear rapid devaluation affecting profitability or operational costs significantly.

To mitigate this issue:

- Stablecoins pegged against fiat currencies are gaining popularity.

- Derivative products offer hedging options.

- Developing more mature markets with higher liquidity can reduce volatility over time.However—as long as speculative trading dominates crypto markets—the risk associated with sudden price swings will remain an obstacle for mass adoption.

Infrastructure Development: Building Reliable Payment Ecosystems

A well-developed infrastructure is fundamental for seamless cryptocurrency transactions—from user-friendly wallets to integrated payment systems capable of handling high transaction volumes efficiently.

Recent initiatives demonstrate progress: In April 2025 , firms like Cantor Financial Group partnered with Tether and SoftBank launching Twenty One Capital—aimingto become oneoftheworld’s largest bitcoin treasuries—which underscores ongoing efforts toward infrastructure expansion[3].

Despite such developments:

- Many regions still lack reliable payment gateways supporting cryptocurrencies.

- Transaction speeds remain inconsistent across networks.

- High fees during peak times hinder usability at scale.These limitations restrict everyday use cases like retail shopping or remittances—key drivers needed for mainstream acceptance—and highlight areas requiring further technological innovation such as layer 2 scaling solutions (e.g., Lightning Network)and sharding techniquesto improve throughputand reduce costs .

Education Gaps Hindering Broader Public Understanding

A significant portion of potential users still lacks foundational knowledge about how cryptocurrencies work—including blockchain technology's benefits versus risks—which hampers wider acceptance beyond tech-savvy communities .

Efforts are underway globally through educational campaigns aimed at demystifying cryptos’ mechanicsand promoting responsible investing practices . Nonetheless , misconceptions persist regarding issues like decentralization , privacy , taxation,and environmental impact .

Bridging this knowledge gap is crucial because informed consumers tendto make better decisions —whether adopting new payment methodsor investing responsibly —ultimately fostering trustand encouraging broader participationincryptocurrency ecosystems .

Environmental Concerns Affecting Regulatory Policies

The energy consumption associated with mining certain proof-of-work cryptocurrencies has sparked environmental debates worldwide . Critics argue that large-scale mining operations consume vast amountsof electricity —sometimes sourcedfrom fossil fuels—raising sustainability questions .

Some countries have responded by exploring greener alternatives:

- Transitioning towards renewable energy-powered mining farms

- Promoting proof-of-stake consensus mechanisms which require less energyNegative perceptions about environmental impact could influence future regulations , potentially leading tomore restrictive policiesthat limit mining activitiesor impose carbon taxeson miners[6].

Addressing these concerns involves balancing technological innovationwith ecological responsibility—to ensure sustainable growth without compromising environmental integrity .

Scalability Challenges Limiting Transaction Capacity

As demand increases,the current capacity limitsof many blockchain networks become apparent . High transaction feesand slow confirmation times during peak periods hinder practical usage scenarios like retail paymentsor microtransactions .

Research teams are actively working on solutions:1.Layer 2 scaling solutionssuch as state channelsand sidechains aimto offload transactionsfrom main chains .2.Sharding techniques distribute network loadacross multiple segmentsfor increased throughput .3.Blockchain interoperability protocols facilitate communication between different networks,to create unified ecosystems capableof handling larger volumes seamlessly[7].

Without effective scalability improvements,this bottleneck could resultin user frustration,reduced transaction speed,and higher costs—all factors discouraging mass adoption across diverse sectors including finance,e-commerce,and remittances.

Navigating Future Pathways Toward Widespread Adoption

Overcoming these multifaceted challenges requires coordinated efforts among regulators,businesses,and technologists alike.To foster trust,safety,and efficiency within cryptocurrency ecosystems,the industry must prioritize transparent regulation development,enforce rigorous security standards,and invest heavilyin infrastructural upgrades alongwith public education initiatives .

Furthermore,the evolution towards sustainable practices addressing environmental impacts will be critical—not only ethically but also politically—to avoid restrictive legislation that might stifle innovation.[8] As research progresseson scalability solutions,the promise remains high: creating faster,morereliable,inclusivecrypto networks capableof supporting global economic integration.

Final Thoughts

While numerous hurdles stand between current state-of-the-art blockchain applicationsand full-fledged global crypto adoption,it’s evident that proactive strategies targeting regulation clarity,safety enhancements,infrastructure robustness,population education,sustainability measures,and scalable technology development will shape future success stories . The path forward involves collaborative effortsto unlockcryptocurrencies’ transformative potential while mitigating risks inherent within emerging technologies.

References

1. [Link]

2. [Link]

3. [Link]

4. [Link]

5. [Link]

6. [Link]

7. [Link]

8. [Link]

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

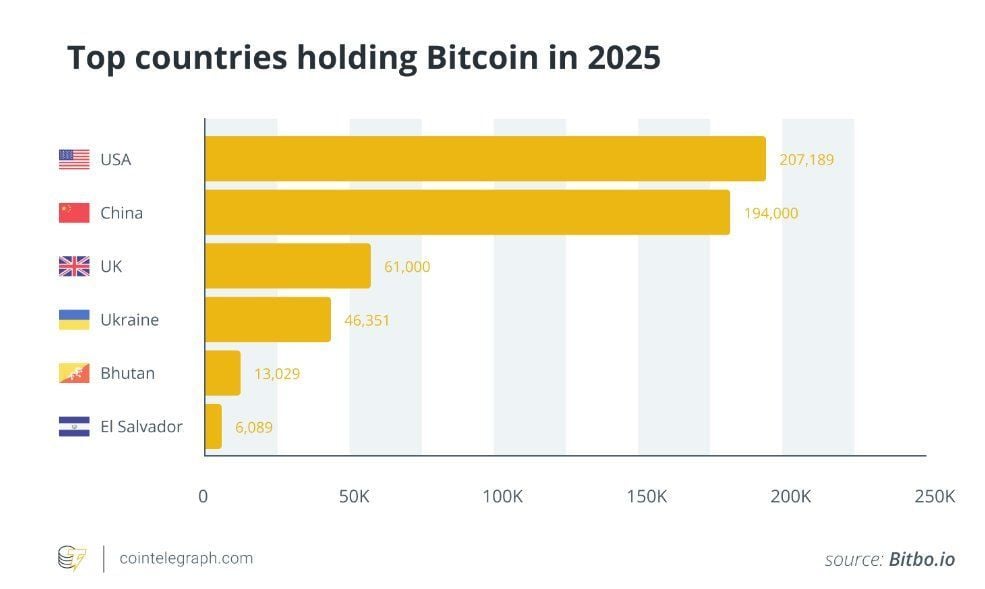

🎯 La concentration s’accélère : moins de mains, plus de pouvoir.

👉 Bonne ou mauvaise nouvelle pour l’avenir du réseau ?

#Bitcoin #crypto $BTC/USDT

Carmelita

2025-08-31 17:10

UPDATE: Une seule stratégie détient désormais plus de $BTC que les 6 plus grands pays réunis.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

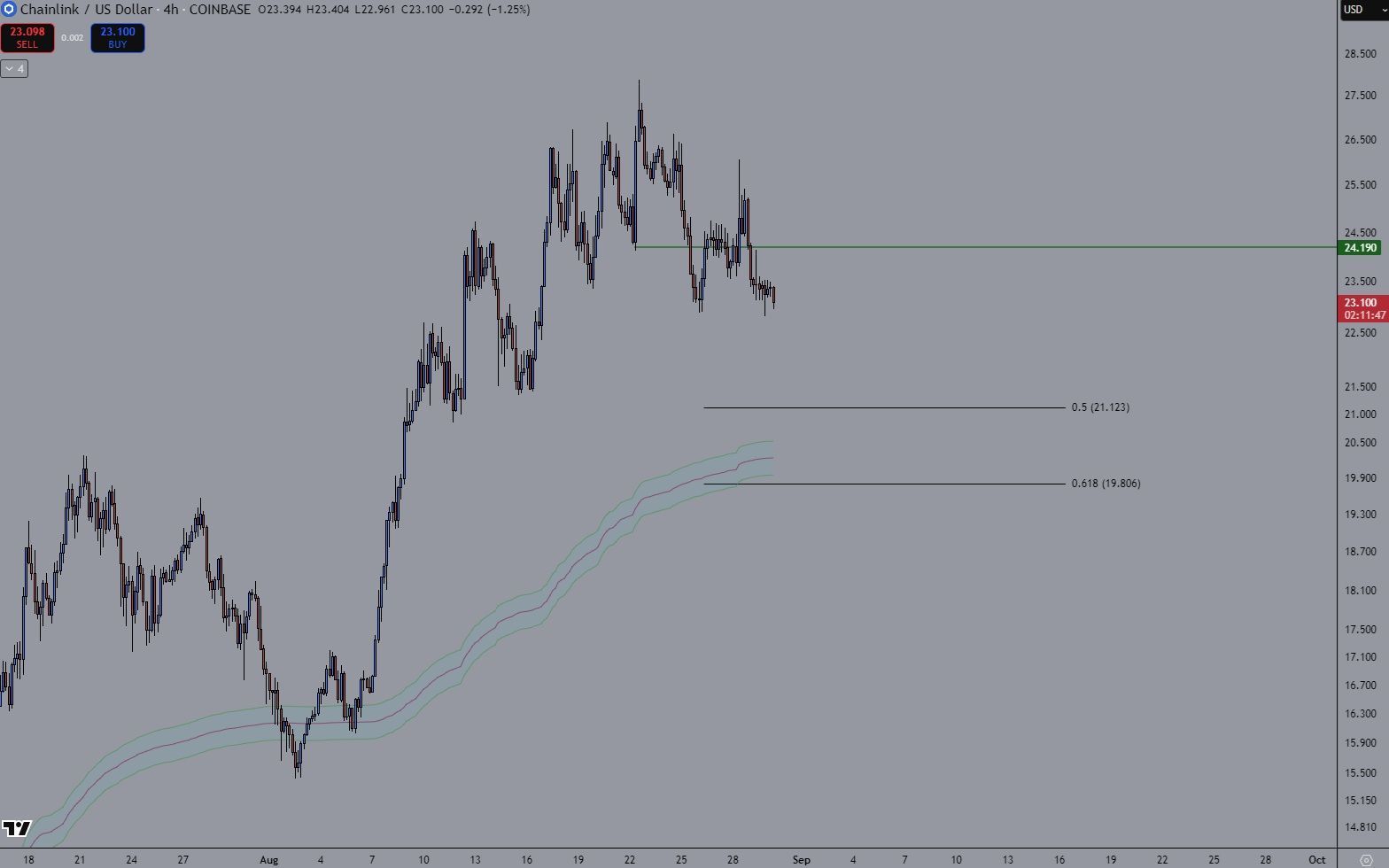

La zone des $20 reste notre buy zone stratégique.

⏳ Patience = puissance. On attend le bon signal avant de frapper. 🚀

👉 Tu accumules ou tu restes en sidelines ?

#Chainlink #crypto

Carmelita

2025-08-30 23:42

$LINK toujours sous surveillance.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

What Is Impermanent Loss in Crypto?

Impermanent loss is a fundamental concept in the decentralized finance (DeFi) ecosystem that every liquidity provider (LP) should understand. It refers to the potential financial loss that can occur when providing liquidity to a decentralized exchange (DEX). While offering liquidity can generate passive income through trading fees, impermanent loss highlights the risks involved, especially during volatile market conditions.

Understanding Impermanent Loss

At its core, impermanent loss happens because of price fluctuations between two tokens within a liquidity pool. When LPs deposit tokens into a pool—say ETH and USDT—they are effectively supplying both assets to facilitate trades on platforms like Uniswap or SushiSwap. The pool uses an automated market maker (AMM) algorithm to maintain balance and enable seamless trading.

However, if one token's price changes significantly relative to the other after your deposit, the value of your pooled assets may be less than simply holding those tokens outside the pool. This discrepancy is what we call "impermanent" because it isn't realized as an actual loss until you withdraw your funds; if prices revert or stabilize before withdrawal, some or all of this potential loss can be mitigated.

Why Does Impermanent Loss Occur?

Impermanent loss results from how AMMs manage token ratios based on current prices rather than fixed quantities. When traders swap tokens within a pool, they cause shifts in token balances which impact LPs' holdings. For example:

- If Token A's price increases significantly compared to Token B,

- The AMM automatically adjusts by selling some of Token A for more of Token B,

- Leading to an imbalance where LPs hold fewer high-value tokens and more low-value ones upon withdrawal.

This process means that even though trading fees earned might offset some losses, substantial price swings can still lead LPs into negative returns relative to simply holding their original assets.

Factors That Influence Impermanent Loss

Several factors determine how much impermanent loss an LP might experience:

Market Volatility: High volatility causes larger price swings and increases risk.

Token Pair Correlation: Well-correlated pairs like stablecoins tend to have lower impermanence risk compared with volatile pairs such as ETH/ALT coins.

Pool Size and Liquidity Depth: Larger pools with deep liquidity tend to absorb shocks better; smaller pools are more susceptible to manipulation or large swings.

Market Trends: Rapid upward or downward trends amplify potential losses during periods of significant movement.

Understanding these factors helps LPs assess whether providing liquidity aligns with their risk appetite and investment goals.

Strategies for Managing Impermanent Loss

While impermanent loss cannot be entirely eliminated without sacrificing potential earnings from trading fees, several strategies help mitigate its impact:

Diversification: Spreading investments across multiple pools reduces exposure concentrated in one asset pair.

Choosing Stablecoin Pairs: Pools involving stablecoins like USDC/USDT minimize volatility-related risks.

Monitoring Market Conditions: Staying informed about market trends allows timely decisions about adding or removing liquidity.

Utilizing Risk Management Tools: Some DeFi platforms offer features such as dynamic fee adjustments or insurance options designed specifically for reducing impermanence risks.

Yield Farming & Incentives: Combining staking rewards with fee earnings can offset potential losses over time.

By applying these approaches thoughtfully, users can better balance earning opportunities against associated risks.

Recent Developments Addressing Impermanent Loss

The DeFi sector has seen ongoing innovation aimed at reducing impermanence concerns:

Several platforms now incorporate dynamic fee structures that increase transaction costs during high volatility periods—compensating LPs for increased risk.

New protocols are experimenting with hybrid models combining AMMs with order book mechanisms for improved stability.

Education initiatives focus on increasing user awareness around impermanent loss so investors make informed decisions rather than relying solely on platform marketing claims.

Additionally, regulatory scrutiny has increased transparency requirements around disclosures related to impermanence risks—a move aimed at protecting retail investors from unexpected losses while fostering trust in DeFi ecosystems.

Potential Risks Beyond Financial Losses

Impermanent loss not only affects individual users but also has broader implications:

Reduced user confidence could slow down adoption if participants perceive high risks without adequate safeguards.

Lack of transparency regarding possible losses may attract regulatory attention—potentially leading toward stricter compliance standards across jurisdictions.

Furthermore, significant instances of large-scale withdrawals due to perceived unrecoverable losses could contribute negatively toward overall market stability within DeFi ecosystems.

Navigating Impermanent Loss Effectively

For anyone considering participating as an LP in crypto markets via DEXes, understanding how impermanent loss works is crucial for making informed decisions aligned with personal investment strategies. While it presents inherent risks tied closely with market volatility and asset selection choices, ongoing innovations aim at minimizing its impact through smarter protocol design and better educational resources.

By staying updated on recent developments—and employing sound risk management practices—investors can enjoy the benefits offered by DeFi’s yield opportunities while safeguarding their capital against unnecessary exposure.

Keywords: Imper permanentloss crypto | Decentralized Finance Risks | Liquidity Pool Management | Crypto Market Volatility | DeFi Investment Strategies

Lo

2025-05-14 06:40

What is impermanent loss?

What Is Impermanent Loss in Crypto?

Impermanent loss is a fundamental concept in the decentralized finance (DeFi) ecosystem that every liquidity provider (LP) should understand. It refers to the potential financial loss that can occur when providing liquidity to a decentralized exchange (DEX). While offering liquidity can generate passive income through trading fees, impermanent loss highlights the risks involved, especially during volatile market conditions.

Understanding Impermanent Loss

At its core, impermanent loss happens because of price fluctuations between two tokens within a liquidity pool. When LPs deposit tokens into a pool—say ETH and USDT—they are effectively supplying both assets to facilitate trades on platforms like Uniswap or SushiSwap. The pool uses an automated market maker (AMM) algorithm to maintain balance and enable seamless trading.

However, if one token's price changes significantly relative to the other after your deposit, the value of your pooled assets may be less than simply holding those tokens outside the pool. This discrepancy is what we call "impermanent" because it isn't realized as an actual loss until you withdraw your funds; if prices revert or stabilize before withdrawal, some or all of this potential loss can be mitigated.

Why Does Impermanent Loss Occur?

Impermanent loss results from how AMMs manage token ratios based on current prices rather than fixed quantities. When traders swap tokens within a pool, they cause shifts in token balances which impact LPs' holdings. For example:

- If Token A's price increases significantly compared to Token B,

- The AMM automatically adjusts by selling some of Token A for more of Token B,

- Leading to an imbalance where LPs hold fewer high-value tokens and more low-value ones upon withdrawal.

This process means that even though trading fees earned might offset some losses, substantial price swings can still lead LPs into negative returns relative to simply holding their original assets.

Factors That Influence Impermanent Loss

Several factors determine how much impermanent loss an LP might experience:

Market Volatility: High volatility causes larger price swings and increases risk.

Token Pair Correlation: Well-correlated pairs like stablecoins tend to have lower impermanence risk compared with volatile pairs such as ETH/ALT coins.

Pool Size and Liquidity Depth: Larger pools with deep liquidity tend to absorb shocks better; smaller pools are more susceptible to manipulation or large swings.

Market Trends: Rapid upward or downward trends amplify potential losses during periods of significant movement.

Understanding these factors helps LPs assess whether providing liquidity aligns with their risk appetite and investment goals.

Strategies for Managing Impermanent Loss

While impermanent loss cannot be entirely eliminated without sacrificing potential earnings from trading fees, several strategies help mitigate its impact:

Diversification: Spreading investments across multiple pools reduces exposure concentrated in one asset pair.

Choosing Stablecoin Pairs: Pools involving stablecoins like USDC/USDT minimize volatility-related risks.

Monitoring Market Conditions: Staying informed about market trends allows timely decisions about adding or removing liquidity.

Utilizing Risk Management Tools: Some DeFi platforms offer features such as dynamic fee adjustments or insurance options designed specifically for reducing impermanence risks.

Yield Farming & Incentives: Combining staking rewards with fee earnings can offset potential losses over time.

By applying these approaches thoughtfully, users can better balance earning opportunities against associated risks.

Recent Developments Addressing Impermanent Loss

The DeFi sector has seen ongoing innovation aimed at reducing impermanence concerns:

Several platforms now incorporate dynamic fee structures that increase transaction costs during high volatility periods—compensating LPs for increased risk.

New protocols are experimenting with hybrid models combining AMMs with order book mechanisms for improved stability.

Education initiatives focus on increasing user awareness around impermanent loss so investors make informed decisions rather than relying solely on platform marketing claims.

Additionally, regulatory scrutiny has increased transparency requirements around disclosures related to impermanence risks—a move aimed at protecting retail investors from unexpected losses while fostering trust in DeFi ecosystems.

Potential Risks Beyond Financial Losses

Impermanent loss not only affects individual users but also has broader implications:

Reduced user confidence could slow down adoption if participants perceive high risks without adequate safeguards.

Lack of transparency regarding possible losses may attract regulatory attention—potentially leading toward stricter compliance standards across jurisdictions.

Furthermore, significant instances of large-scale withdrawals due to perceived unrecoverable losses could contribute negatively toward overall market stability within DeFi ecosystems.

Navigating Impermanent Loss Effectively

For anyone considering participating as an LP in crypto markets via DEXes, understanding how impermanent loss works is crucial for making informed decisions aligned with personal investment strategies. While it presents inherent risks tied closely with market volatility and asset selection choices, ongoing innovations aim at minimizing its impact through smarter protocol design and better educational resources.

By staying updated on recent developments—and employing sound risk management practices—investors can enjoy the benefits offered by DeFi’s yield opportunities while safeguarding their capital against unnecessary exposure.

Keywords: Imper permanentloss crypto | Decentralized Finance Risks | Liquidity Pool Management | Crypto Market Volatility | DeFi Investment Strategies

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

1280 utilisateurs couverts cette semaine ! 🚀

📌 Rappel des règles : • Perte nette ≥ 500 USDT ➡️ Allocation 1:1 en puissance de calcul • Puissance permanente générant des $JU/USDT quotidiens • Gains vérifiables on-chain, transparents et fiables

📅 Période de référence Week 8 : 4 juillet – 10 août 2025

#JuCoin #blockchain #crypto

Carmelita

2025-08-08 10:27

💙 JuCoin Computing Power – Week 7 ✅

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》

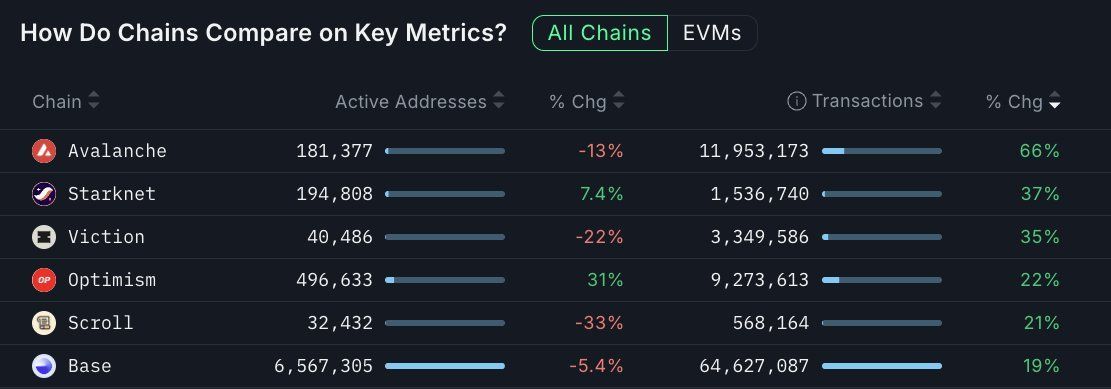

$AVAX/USDT … et Grayscale qui vient de déposer un ETF spot.

$AVAX/USDT ? 👀

#Avalanche #crypto

Carmelita

2025-08-31 00:20

🔥 Avalanche explose les compteurs : +66% de transactions cette semaine, franchissant 11.9M txns.

免責聲明:含第三方內容,非財務建議。

詳見《條款和條件》